Does Your Fund’s Math Even Math?

Ownership percentage is one of the most overused talking points in venture — and one of the most misunderstood when it comes to actual fund strategy.

You’ll hear GPs say, “We target 10% ownership at Seed,” as if that’s the golden number. But what does 10% mean if you don’t have the capital to defend it. Worse, I keep seeing fund strategies where something is fundamentally off — either the portfolio construction is too aggressive, or the reserves for follow-on are way too light.

And one thing I rarely see clearly communicated:

Are you talking about initial ownership or the ownership you want to hold through exit?

Because those are two very different things — and they have very different capital requirements.

Let’s walk through an example.

How Much Do Seed Investors Actually Lose to Dilution?

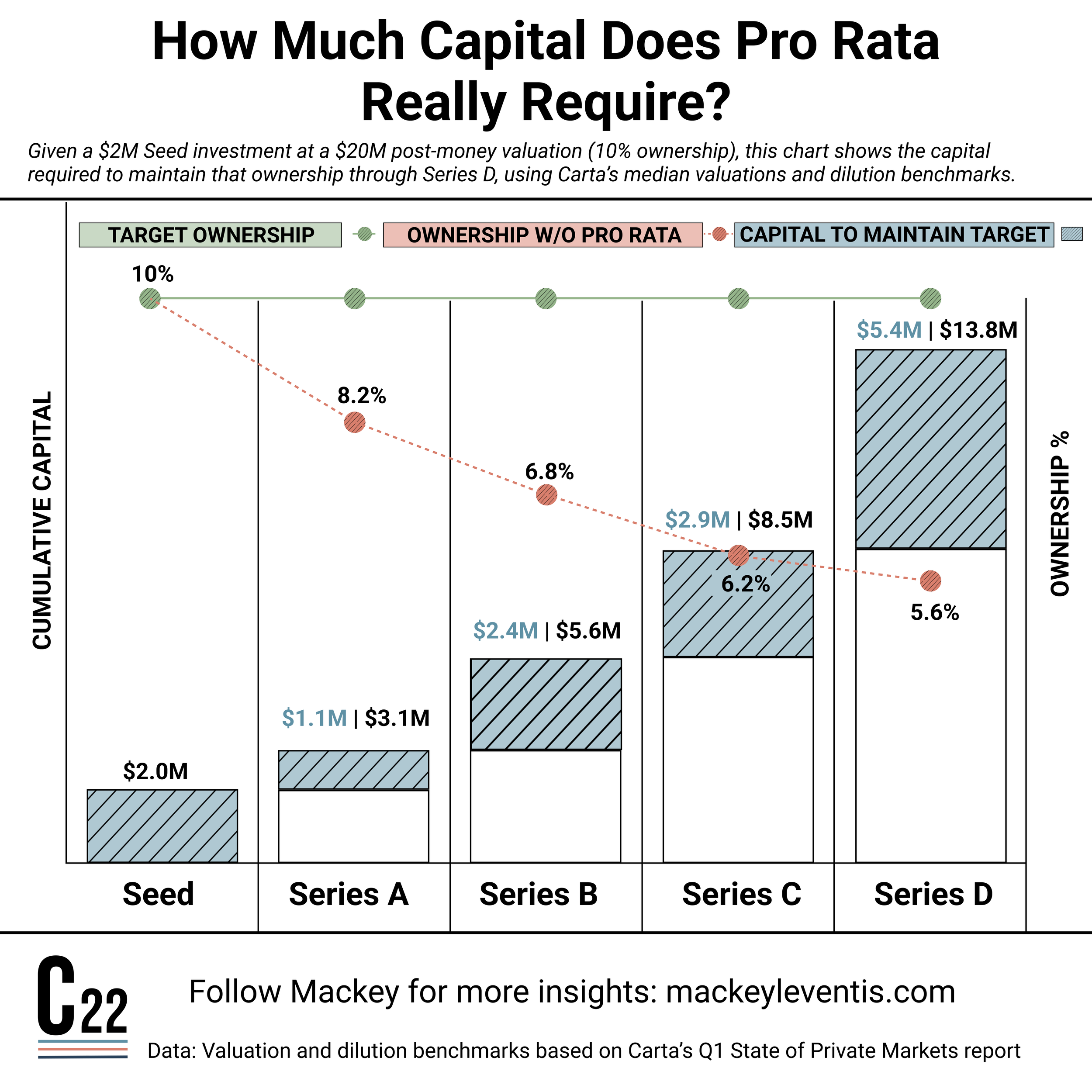

Say you’re a seed investor and you just landed a great deal: $2M into a $20M post-money valuation. Boom — you’ve got your 10%.

But before wiring the money, you pause and ask:

What happens to that 10% as the company raises a Series A, B, C, and maybe even a D?

It’s not an easy question. It depends on a ton of variables — pro rata rights, round size, valuation step-ups, insider politics, and whether you’re even invited back in. But to ground the math, I built a model using Carta’s median valuation and dilution benchmarks to get a rough picture.

Here's what it shows:

Holding your 10% stake through Series D would require $11.8M in follow-ons

If you don’t follow on at all? You’ll end up with ~5.6% ownership by Series D

That’s a nearly 50% haircut, and that’s under fairly optimistic conditions: smooth sailing, clean terms, and full pro rata access.

Let’s Talk About Fund Strategy

Now ask yourself:

If you're running a $100M fund writing $2M seed checks into ~40 companies, and holding back ~20% for follow-ons, does that math support 10% ownership across the board?

Short answer: No.

You’d be committing $80M up front ($2M × 40), which leaves you with just $20M in follow-on. But if just one of those companies breaks out and you want to hold 10%, you might need more than half that reserve for a single deal. Multiply that across a few winners, and you’re quickly out of dry powder.

So when I hear managers casually toss around 10% ownership targets, I start wondering:

Is that 10% just at entry, or are you planning to maintain it through future rounds?

Does your portfolio construction actually support that strategy?

Or are you just hoping dilution won’t be too bad?

The Takeaway

Your ownership target isn’t just a flex. It needs to connect — mathematically — to the capital you're managing, your reserve strategy, and how many bets you’re placing.

If you're not clear whether you're targeting 10% at entry or 10% long-term, you're setting yourself (and your LPs) up for mismatched expectations.

And while holding ownership can be critical for fund returns, remember: you have more control over your fund’s strategy than you do over dilution. Get the strategy right first.

Want to see if your fund’s math checks out?

I’ve linked the dilution model I built — plug in your numbers and find out.