The Creative Power of Operations (Helping EMs with KPI Collection)

The Operations job function gets a bad rep for being boring, but it’s actually the most creative role in a company.

For example, Venture Operations is a difficult topic to discuss because so much of the work involves visualizing how a system works and then actually implementing it. Most people are good at describing how they want a system to work, but it is only after they experience the limitations of implementation that things get tricky.

People who enjoy working in Operations find these "tricky," opaque situations to be the most rewarding part of the job. These gray areas allow Operators to act creatively. I always say my superpower is creative problem-solving. People often pretend to understand what I mean, but I’m specifically talking about the creativity required to overcome the constraints we encounter from capital, people, software, and a dozen other variables.

Why Parameters Kill Companies

Great Operators don’t react when told to do "impossible" things. They know arguing is a waste of time because they are the ones who will eventually have to get creative to solve the problem anyway. They already know the task is impossible as described, but they also know they just need to solve the problem—not necessarily in the exact way they were instructed.

This is why placing rigid parameters on Operators kills companies. Operators are already facilitating impossible requests by navigating with creativity; placing more parameters on them only reduces the tools they have to find a solution.

The Investment Case for Ops

I love companies that are focused on Operations. It’s an investment thesis of mine stemming from the fact that 50% of hedge fund failures are attributable to operational risk alone—not investment risk, but Operations! When a company is focused on helping other businesses operate, or when a company demonstrates strong internal operations, I’m interested.

The Venture Operations Constraint

Venture Operations are unique because, despite being at an investment firm, these teams are usually quite capitally constrained. They have to be incredibly conscious of every dollar spent. This is even more difficult for Emerging Managers. They have significantly less capital, yet a $20M fund requires almost the same level of operational upkeep as a $200M fund.

The emerging manager space is rough. While there are a growing number of tools out there to support them, many providers don't understand that an emerging manager cannot afford to pay $10,000 for software to track portfolio company KPIs and financials—even though it’s a vital function. That’s why I was upset to see that JP Morgan is set to close Aumni, a company that was focused on exactly that: portfolio company information recording.

A Solution for Emerging Managers

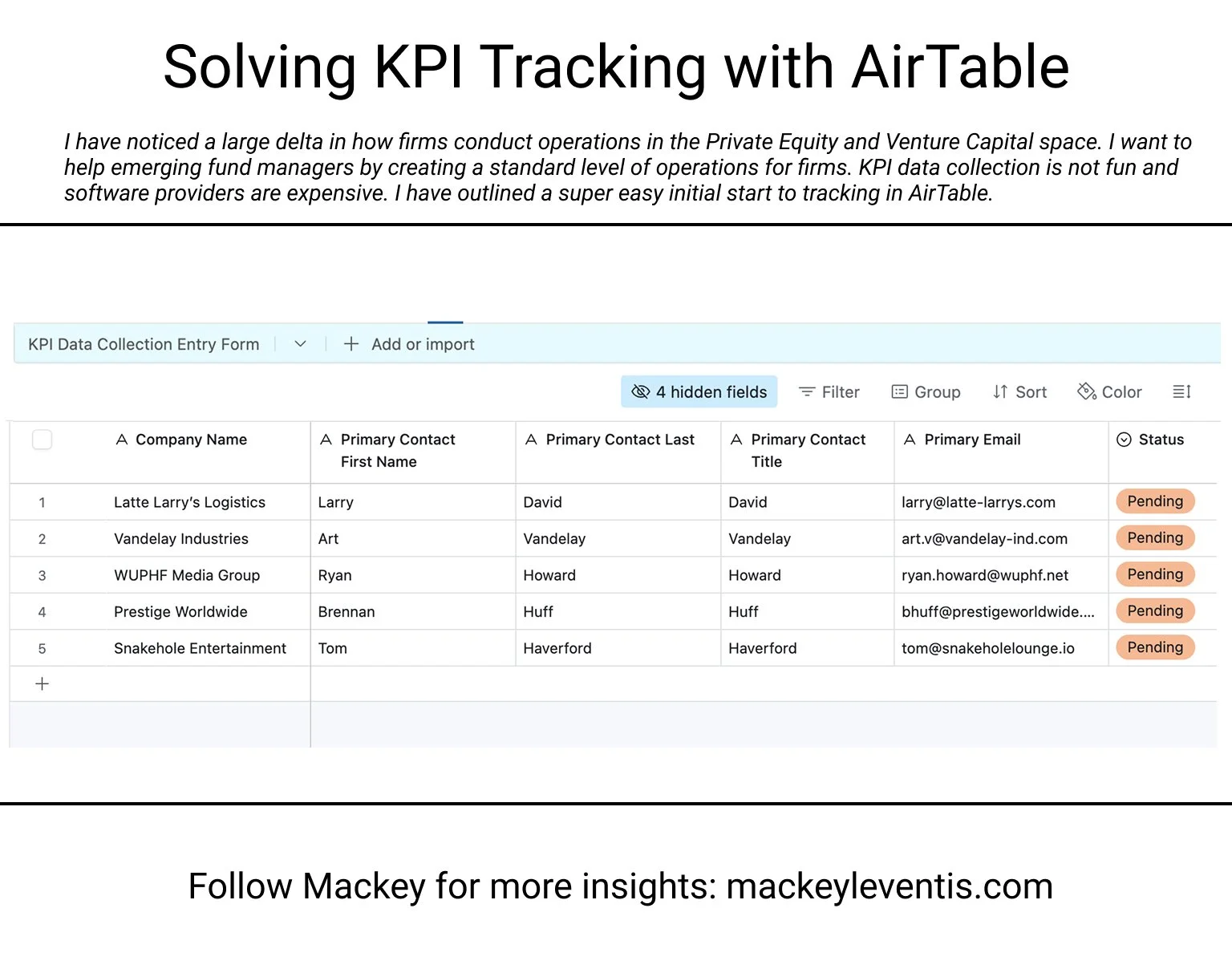

Since portfolio company financial and KPI tracking is so time-consuming, I wanted to put together a simple, cost-effective system for Emerging Managers to leverage.

I have attached a Loom video here (capped at 5 minutes). If you would like to learn more about how to set up a system like this and what its limitations are, I would love to chat: mackey@catch22.vc